As a result of pending anti-union legislation, I have been researching union issues for the last few weeks, especially with respect to libertarian philosophy. Historically, libertarians, in a political coalition with business interests on the right, have opposed unions, but is there room to ally with liberals here?

In order to answer this question, we need to understand the proposed changes.

The first is hidden at the very bottom of the intimidating, hundreds-of-pages-long

HB2, which addresses all sorts of vaguely budget-related issues. (It took me something like 20 minutes to find the actual text of the amendment. So when critics complain that the legislating process in this case has not been very open or democratic, they have a good point.)

462 New Paragraph; Impasse in Collective Bargaining. Amend RSA 273-A:12 by inserting after paragraph VII the following new paragraph:

VIII. For any collective bargaining agreement entered into by the parties after the effective date of this paragraph, if the impasse is not resolved at the time of the expiration of the parties’ agreement, the terms of the collective bargaining agreement shall cease and all employees subject to the agreement shall become at-will employees whose salaries, benefits, and terms and conditions of employment shall be at the discretion of the employer.

This reverses paragraph VII of

RSA 273-A:12 Resolution of Disputes, which applies to public employee labor relations:

VII. For collective bargaining agreements entered into after the effective date of this section, if the impasse is not resolved at the time of the expiration of the parties' agreement, the terms of the collective bargaining agreement shall continue in force and effect, including but not limited to the continuation of any pay plan included in the agreement, until a new agreement shall be executed. Provided, however, that for the purposes of this paragraph, the terms shall not include cost of living increases and nothing in this paragraph shall require payments of cost of living increases during the time period between contracts.

It is not clear that this has any relation to libertarian philosophy.

Currently, if contract negotiations fail, the government automatically extends the old, expiring contract. Basically, all government labor contracts have an implicit

evergreen clause. If this amendment becomes law, failed negotiations will revert, instead, to a situation where government employees can be fired at the whim of their employer. (Though, as

Diana Lacey explains, the change will not apply to current contracts, giving unions a perverse incentive to ride out their current contracts until someone alters the law to allow evergreen clauses again.)

So no one is having their freedom restricted or extended. The government is simply altering the way it does business.

From a more practical perspective, this would take away bargaining power from public-sector unions. Do we want that? Not necessarily. Chesterfield Democrat

Tully Fitzsimmons points out that the government, besides being a coercive monopoly, is also, in many cases, a monopsony-- that is, the only buyer in a market. And unlike private employers, the government does not have to follow its own labor contracts. Legislators can alter the contracts as they wish. Union bargaining power may be required to balance these unfair advantages.

(Interestingly, economic theory suggests that a market with both a monopoly and a monopsony, known as a

bilateral monopoly, can be more economically efficient -- less wasteful -- than a market with a monopoly alone, or only a monopsony. It is not clear, though, that this is happening between public-sector unions and government employers, given

the current state of government workers. What

is clear is that union bargaining power redistributes wealth from the government to government employees. Beast-starvers, take note.)

Another argument from those opposed to public-sector unions is that the unions lobby for more government. And this is true. But,

as Grant Bosse has explained, contrary to some claims from the left, this will hardly end public-sector unions. So it's a moot point.

The second piece of legislation is

HB474, the right-to-work bill.

The bill is sold as an expansion of individual liberties. However, the fine print reveals that it "prohibits collective bargaining agreements that require employees to join a labor union." In other words, this is a "positive" liberty, which requires the government to intervene in private affairs in order to provide it-- closer to the right to health care than the right to free speech. In 2004

the platform of the Libertarian Party opposed right-to-work laws for this reason.

I've heard three main arguments anti-union libertarians use to excuse their interference with consensual agreements in this case.

One is economic-- unions, they say, are cartels of labor. They drive up prices, restrict employment, and redistribute wealth from poorer workers (who are now unemployed) to more established workers.

To help evaluate these arguments, I turned to

What Do Unions Do?, a book by Richard Freeman and James Medoff, both pro-union labor economists. (A group of more conservative-minded economists recently devoted

another book to reviewing this one, and found that it was generally correct.)

It turns out that the redistributive effects are progressive (for those who care about that sort of thing). And union-induced inflation is small.

Freeman and Madoff agree that unions are basically cartels of labor, but they argue that the harmful aspects of labor unions are subject to considerable economic restraints. In a competitive market, if a union raises wages, it will simply put its employer out of business. Knowing this, the union focuses less on using its monopoly power to raise wages and more on economically benign improvements to workers' experience in the workplace. In less competitive markets, unions are sometimes able to gain more influence. (Other times large employers will use their market power to undermine union efforts.) Occasionally unions are able to organize the entire workforce of a competitive market, and coordinate wage demands between them, but this is rarer.

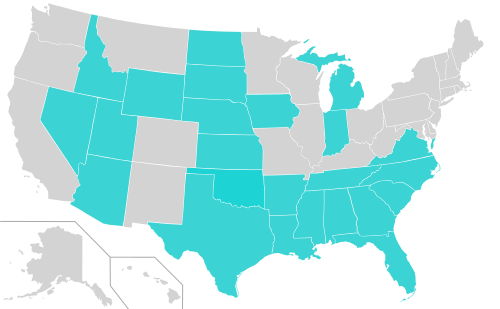

According to Freeman and Madoff, the economic loss resulting from union efforts in 1980 was about 0.3% of U.S. GDP. In New Hampshire today, unionization levels are lower (

The Center for American Progress says 12.4%), and the union vs. non-union wage gap is lower. Using the same methodology, I estimate that the current economic losses in New Hampshire due to unions are approximately 0.05% of NH GDP, which is the equivalent of about $22 per person per year ($28.5 million).*

Of course, even with right-to-work laws, unions will still be around.

The Sentinel has argued that the proposed law would have relatively minor effects. If we err on the side of a larger effect, halving the economic costs of unionization, that still only creates the equivalent of $11 per person, or $14 million. (My math has been a little crude, but this should be a decent ballpark estimate of the effect of the bill.)

To put this in a different perspective, libertarians were willing to pay $2.85 per person

($3.7 million) in lost federal money in order to forgo seat belt laws. (And arguably

much more.) How much are collective bargaining rights worth in comparison?

(The Center for American Progress' paper also notes that a decline in unionization would hurt the economy by lowering the income of some workers. This is true, in the short run, if you accept modern Keynesian macroeonomics. But the sword cuts both ways-- if the economic losses from union monopoly power are small, then the short-run gains are also small.)

A second argument in favor of right-to-work is that the government already intervenes on labor's side in a variety of ways, so it's only fair that it intervene in favor of business, to correct the imbalance.

A quick perusal of my handy labor economics textbook shows that the empirical side of this argument is true. Employer rights are abridged by the

Norris–La Guardia Act and the

Wagner Act. (Though the

Taft–Hartley Act later added some restrictions to unions.) However, I don't find this argument persuasive. The important question is, do we prefer the situation under the current law, or would we prefer the outcomes produced by a right-to-work law? What does it matter that the government has already changed some things?

The last argument is political. Unions lobby for bigger government, and a right-to-work law would presumably undermine their lobbying strength.

On the federal level, Freeman and Madoff find this to be true, to a degree. Unions generally do not succeed in promoting specifically pro-union legislation, due to strong business resistance, but they do help pass (allegedly) pro-worker legislation, such as minimum wage increases and workplace safety laws. And even under a right-to-work system, unions will still be around, and they'll still lobby the government (only less intensely). Based on the information available, it is probably impossible to predict if a right-to-work law would be one step back for two steps forward, or two steps back for one step forward.

So what's the takeaway for libertarians?

Much as I'd like to, I can't make an airtight case for the libertarian support of unions. At the same time, the anti-union case itself leaves much to be desired.

Are union issues full of potential for liberal-libertarian cooperation? I don't know. There's plenty of room for libertarians on both sides of the debate.

*

Mathematical note:

To arrive at their estimate, Freeman and Madoff use the equation

½ × (union wage effect)/100 × (decline in employment in union sector due to wage effect)/100 × (fraction of labor force in unions) × (the fraction of total costs associated with labor) = (deadweight loss)

"This formula estimates the size of the triangle under the demand curve for union labor, which provides an estimate of what the social loss would be if all output were produced under collective bargaining, and then multiplies this amount by an estimate of the fraction of all output produced in unionized settings." (Freeman and Madoff,

What Do Unions Do?, 1984, p. 267)

The equation is taken from Arnold Harberger, 1971, "Three Theorems of Applied Welfare Economics".

David Madland and Karla Walter, at the

Center For American Progress, cite the union wage effect in New Hampshire as 7% (p. 2 of the .pdf). However, as far as I can make out, this estimate does not include fringe benefits, which implies that it is biased downward. It also does not account for the positive effects that union wages have on the wages of non-union workers, which would further bias the estimate downward. Finally, they note that, for other, more technical reasons, they expect their estimate to be biased downward (see note 2 on p. 4 of the .pdf). Rather than try to correct for this somehow, I decided to substitute it with federal-level data. I found this in

a Cornell study, which in turn took the data from Barry Hirsch and David MacPherson's

Union Membership and Earnings Data Book (p. 12 of the .pdf). They estimate an effect of 14%.

I was also unable to find data on the unemployment induced by higher union wages. To estimate it, I assumed that the amount of unemployment is proportional to the increase in wages. Freeman and Madoff's data suggest that the percentage of union-induced unemployment is about 2/3 of the percent wage increase (that is, a price-elasticity of demand of -.66). Therefore, a 14% wage increase implies a 9.3% decline in employment (14 × 2/3 = 9.3). I do this because I'm guessing that the elasticity of labor demand for union employers in the past will be a decent guide to current labor demand elasticities, because union members will still be employed largely by the same types of employers. This is a slightly dubious approach, as relevant conditions might have changed since their 1980 estimate. Fortunately, according to my labor economics textbook (

Filer, Hamermesh, and Rees, 1996) the long-term price-elasticity of demand is about -1 for the entire labor market, with skilled workers generally having a lower elasticity (that is, greater than -1) and unskilled workers generally having a higher elasticity (less than -1) (p. 167-168). Since skilled workers are disproportionately represented in labor unions, this lends plausibility to my estimate. (Because I am assuming that higher wages cause declines in employment, this estimate does not account for possible employment gains in situations of bilateral monopoly, and this is a source of a possible upward bias.)

The unionization rate is taken from the Center for American Progress paper (p. 2 of the .pdf).

I found the "fraction of total costs associated with labor" (that is, labor's share of output) using data from the U.S. Bureau of Economic Analysis, which can be found via the

NH Economic and Labor Market Information Bureau.

$58.036 billion (total state income) / $35.343 billion (wages, salaries, and benefits) = .609 (labor's share of output)

The final equation is thus:

½ × .14 × .093 × .124 × .61 = 0.00049

Naturally, since I have substituted a federal-level wage gap estimate for what should be a state-level measurement, and because I had to make an educated guess about union-induced unemployment, this number will not be exactly correct. It should be perfectly adequate, however, for its uses in this article.

These numbers imply deadweight losses of about $28.5 million:

$58.036 billion × 0.00049 = $28.5 million

About 1.3 million people live in New Hampshire, implying about $22 of deadweight loss per person:

$28.5 million / 1.3 million people = $22 per person

[This is a slightly polished version of an essay originally posted on

Free Keene.]